Your Competition Started Q4 Prep in July (Here’s How to Catch Up)

It’s early October and you’re thinking about Q4. Now what? You’re already behind. Not trying to scare you, just being honest. While you’re reading this, your competitors locked in their inventory positions back in August. They negotiated their ad budgets in September. Their Lightning Deal applications were submitted weeks ago.

But here’s what 30+ years of combined Amazon experience has taught us: you can still salvage this, maybe even crush it. The difference between brands that thrive and brands that just survive Q4 isn’t perfect planning. It’s knowing exactly where to focus when time’s running out.

Let me show you what actually matters when you’re playing catch-up and more importantly, what successful partnership looks like when Q4 is already breathing down your neck.

The Q4 Reality Nobody Talks About

“We’ll do 40% of our annual revenue in Q4.”

Every Amazon seller says this. Most are lying to themselves.

Know what actually happens? They do 40% of revenue but 15% of profit. Because between emergency air freight, panic ad spending, and desperation discounts, Q4 becomes a cash bonfire.

Here’s the brutal math from last year’s data:

What Brands Expected:

- 10% sales growth (matching Amazon’s overall)

- 25% higher ad costs

- Normal fulfillment fees

- Send inventory in October for November and December sales.

What Actually Happened:

- Sales grew 10% (yay!)

- Ad cost per click jumped 37% by mid-November

- Storage fees tripled

- Amazon warehouses are full or you hit your capacity limits

- Air freight ate $12 per unit

- Stock-outs killed January momentum

One brand I know hit their Q4 revenue target perfectly but also lost $47,000.

Revenue without profit is expensive noise.

Why October Panic Never Works

You’re thinking you can still pull this off. Order inventory now, crank up ads, maybe run some deals.

Let me save you the heartbreak.

The Inventory Death Trap: Order today? Best case, it arrives at Amazon by November 10th. That’s if everything goes perfectly. No port delays, no FC receiving backlogs, no “misplaced” shipments, no capacity limit issues. The reality is that you’re looking at November 20th. For products that need to sell by November 28th (Black Friday).

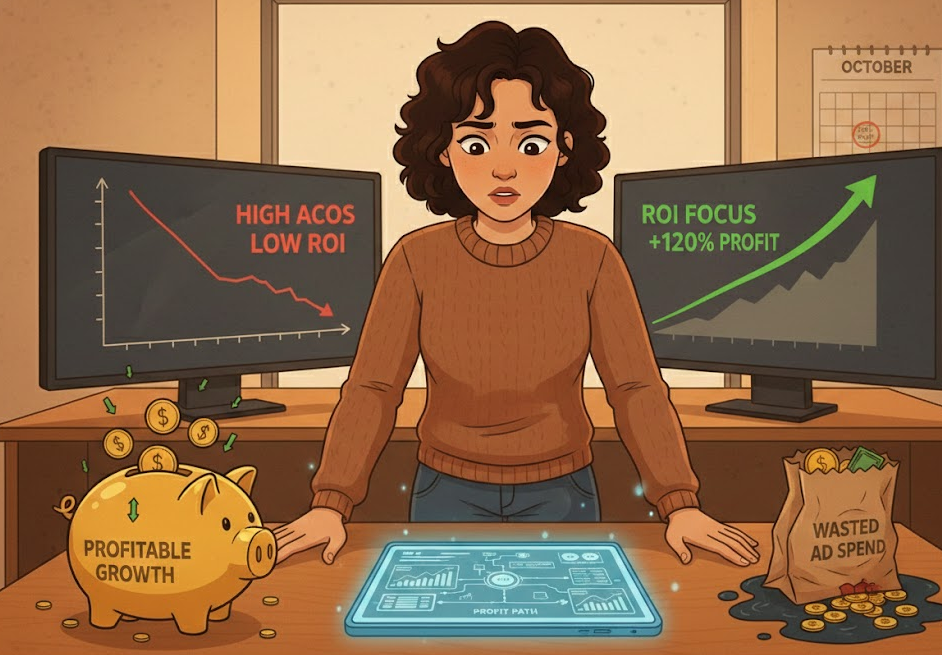

The Ad Budget Massacre: Those CPCs that jumped 15% last quarter? They’ll double again by Thanksgiving. Your perfectly profitable $2.50 CPC becomes $5.00. That 25% ACoS turns to 55% and cutting back means disappearing entirely while competitors with deeper pockets dominate.

The Review Desert: Need reviews for conversion? Amazon’s early reviewer program has a 3-4 week lag. Vine takes 2-3 weeks if you’re lucky. Launch a new product now and you’re going into Black Friday with zero social proof while established competitors show hundreds of reviews.But the worst part… the January crash.

Everyone thinks Q4 ends December 31st. Wrong. It ends January 15th when returns spike, rankings tank, and you’re sitting on inventory you panic-ordered that’s now worth half what you paid.

The Timeline That Actually Works (For Next Year)

Yeah, I know. You need help NOW, not next year. Stay with me, this matters.

July (Yes, July):

Start forecasting. Not guessing, actual data-driven forecasting. Pull last year’s daily sales, layer in growth, factor in new competition. Most brands just multiplied last year by 1.5 and pray. That’s not forecasting, it’s wishful thinking & gambling with your future.

Calculate your true inventory needs including safety stock. For context, running out on Black Friday doesn’t just kill that day. It drops your ranking so hard that recovery takes until March.

August:

Place orders. All of them. Yes, it feels insane ordering Christmas inventory when it’s 95 degrees outside. But those September production slots are gold. October slots mean November arrival, and November arrival means you’re dead.

September:

Lock in your ad strategy and budget. Not just “we’ll spend more.” Actual campaign structure, keyword targeting, dayparting strategy. Your competitors are already A/B testing their holiday creatives.

Audit your listings. Every. Single. One. Images, bullets, A+ content. The conversion optimization you do in September is worth 10x what you do in November when traffic explodes.

October:

Inventory should be at Amazon. Not shipping to Amazon. AT Amazon. Received, counted, and available.

Launch your pre-holiday campaigns. Not full throttle, but warming up the algorithm, gathering data, identifying what’s working before costs explode.

November:

Execute. Don’t strategize, don’t pivot, don’t panic. Execute the plan you built in August.

What You Can Actually Do Right Now

Alright, enough about next year. You need to save THIS year. Start with triage. You can’t fix everything, so fix what matters.

Focus on your winners only. That product doing $2K monthly? Forget it. Focus 100% on products already performing. They have reviews, they have rank, they can actually convert expensive Q4 traffic. Trying to launch new products now is like opening a lemonade stand during a hurricane.

Protect inventory at all costs. Whatever stock you have, make it last. Raise prices 10-15% immediately. Yes, you’ll lose some sales. But stock-outs kill more than high prices. Use Max Order Quantity settings to prevent bulk buyers from cleaning you out. Set up restock alerts the second inventory drops below 4 weeks of coverage.

Strategic PPC, not panic PPC. Don’t increase budgets across the board. That’s what amateurs do. Instead, cut all experimental campaigns. Focus budget on exact match keywords that convert. Daypart aggressively (7am-11am and 6pm-10pm typically convert best). Use negative keywords religiously to avoid waste.

Fix your listings TODAY. You can’t change inventory, but you can change conversion. Add urgency to your bullets (“Limited Holiday Stock”). Update main images with holiday badges (tastefully). Add gift-focused keywords you missed. These changes take 15 minutes and can boost conversion 20%.

Partner or perish. This is where I’d normally be subtle, but you don’t have time for subtle. If you’re doing more than low six figures annually, trying to navigate Q4 alone right now is borderline negligent. You need someone who’s done this before.

The Hidden Q4 Killers

These are the problems that blindside brands every year:

Returns tsunami in January. That 10% return rate can turn into 30% post-holiday. Factor this into your cash flow NOW or January will hurt.

International copycats. The moment you hit bestseller status, sellers duplicate your listing. They can’t ship until January, but they’ll hijack your traffic with lower prices. Brand Registry and constant monitoring are non-negotiable.

The December 15th cliff. Customers stop buying anything that won’t arrive by Christmas. Sales drop 70% overnight. If you’re not prepared, you’ll panic-discount and destroy margins.

Gift buyer behavior. Q4 customers don’t read descriptions. They buy based on images and price. That detailed A+ content you’re proud of could be worthless and your main image is everything.

Real Numbers: What Q4 Actually Costs

Let’s talk about real money. Not percentages, actual dollars.

For a brand doing $30K/month normally:

- Extra inventory carrying cost: $4,500

- Increased ad spend: $7,000

- Storage fees: $1,200

- Emergency freight (inevitably): $3,000

- Lost margin from price wars: $5,000

Total additional investment: ~$21,000

Return if executed well: $35,000 profit

Return if you wing it: -$8,000 loss

These aren’t made-up numbers. This is what we see every. single. year.

The Partnership Conversation

If your brand is approaching or exceeding six figures annually, Q4 without professional help is like performing surgery on yourself. Possible? Technically. Smart? Never.

We work with brands exactly like yours. Not enterprises with million-dollar budgets. Not beginners with three SKUs. Growing brands trying to breakthrough without breaking down.

Our Q4 emergency response isn’t about taking over (you don’t have time for that). It’s about surgical interventions where they matter most:

- Inventory allocation strategy to prevent stock-outs

- PPC optimization that cuts waste while maintaining visibility

- Competitive intelligence so you know exactly what you’re up against

- Daily monitoring and adjustments because Q4 moves too fast for weekly reviews

But we can’t work miracles. If you’re already out of stock, we can’t manifest inventory. If you’ve got two weeks of coverage heading into Black Friday, we can’t save you from stock-outs.

What we CAN do is maximize what you’ve got, prevent the disasters you don’t see coming, and position you for January recovery while your competitors crash and burn. Then start preparing you for Q2-Q4 2026 early.

Your Next 72 Hours

Stop reading articles. Start executing. Here’s your survival checklist:

Today (next 4 hours):

Audit every SKU’s inventory level. Calculate days of coverage at current velocity times 3 (for Q4 surge). Anything under 45 days is critical. Raise those prices NOW.

Review your ads. Pause everything with ACoS over 50%. You can’t afford education campaigns during Q4. Reallocate that budget to winners.

Tomorrow:

Update all listings with urgency and gift angles. Add “Limited Holiday Stock” to titles where true. Include “Gift-Ready” in bullets. Update backend keywords with gift-related terms.

Call your supplier. Beg, borrow, or bribe your way to any additional inventory. Air freight hurts less than stock-outs.

Day Three:

Make the partnership decision. Either commit to doing this yourself (and accept the consequences) or get help. Half-measures don’t work in Q4. You’re either all-in alone or you partner up.

The Uncomfortable Truth

Most brands lose money in Q4. Not because Q4 is unprofitable, but because they confuse activity with strategy.

They see competitors advertising everywhere so they increase budgets. They see prices dropping so they match. They see inventory moving fast so they panic-order more.

That’s not strategy, that’s reaction and reaction in Q4 means death by a thousand cuts.

The brands that win Q4 aren’t the ones with the most inventory or biggest ad budgets. They’re the ones with clear plans, realistic expectations, and the discipline to execute without panic.

If you’re reading this in October, you can still be one of them. But the window is measured in days, not weeks.

Last Call for Q4 Success

Every hour you wait, recovery gets harder. Your competitors aren’t waiting. Amazon’s algorithm isn’t waiting and Q4 sure as heck isn’t waiting.

You’ve got two choices:

Try to figure this out yourself. Maybe you’ll get lucky. Maybe your competitors will screw up worse than you. Maybe inventory will magically last longer than math suggests.Or get professional help from people who’ve navigated many Q4 seasons. Who know which shortcuts work and which ones kill you. Who can look at your situation and tell you exactly where to focus for maximum impact.

We’re not for everyone. If you’re doing under six figures annually, you probably can’t justify our partnership. If you’ve got unlimited inventory and budget, you may not need us.

But if you’re in that sweet spot (growing fast, resource-constrained, one bad Q4 from serious trouble) then we need to talk. Today, not next week. Today.

Because Q4 doesn’t care about your timeline.

It’s already here.

Ready to salvage Q4? Let’s evaluate your situation immediately. Get in touch and we’ll tell you if we can help or if you’re better off managing solo. No BS, just honest assessment of your Q4 prospects.

Nick Hinton leads Elbert Mountain’s Peak Season Strategy practice, helping growing Amazon brands navigate the chaos of Q4 and emerge profitable. With over 20 years of combined Amazon experience, Elbert Mountain specializes in emergency interventions and strategic planning for independent brands.