Amazon Profit Optimization: The Hidden Leaks Destroying Your Margins (And How to Plug Them)

Here’s some full transparency about what’s eating your Amazon profits right now: between FBA fees, storage costs, and aged inventory surcharges, most growing brands lose 23% more margin than they realize. And that’s before we even talk about the profit killers hiding in your return rates and unplanned service fees.

I’ve watched hundreds of brands make the same costly mistake. They focus entirely on revenue growth while their actual take-home profit shrinks with every sale. The partnership approach we’ve developed over 20+ years of combined Amazon experience reveals a harsh truth: you can be a bestseller and still lose money. In fact, we regularly see brands doing low six figures annually who are unknowingly operating at negative margins on their top products.

In this guide, I’ll share the systematic profit optimization strategies we use to help growing brands reclaim their margins. You’ll learn how to identify the 7 most common profit leaks, understand when basic spreadsheet analysis hits its limits, and discover exactly how professional optimization can transform your bottom line.

Most importantly, we’ll have an honest conversation about real costs, realistic timelines, and whether DIY profit tracking makes sense for your current revenue level. Because sometimes the smartest investment isn’t in more inventory - it’s in understanding where your money actually goes.

The $6.90 Storage Fee Trap That Nobody Talks About

Let me give you the honest numbers that will make your stomach drop: Amazon charges $6.90 per cubic foot - for Standard-Sized inventory sitting longer than 365 days. But here’s what most brands don’t realize. The aged inventory surcharge actually starts at just 181 days, not a year like everyone assumes.

Think about that for a second. You’ve got inventory that seemed profitable when you ordered it six months ago. Now it’s costing you an additional $1.50 per cubic foot monthly at 181 days, jumping to $3.80 at 271 days. We’ve seen brands discover they’re paying more in storage than they originally paid for the product. One seasonal seller I know had $15,000 worth of inventory turn into $22,000 of storage fees because they missed the 181-day mark during the slow season.

The real killer? These fees compound with Q4 storage rates that triple from $0.78 to $2.40 per cubic foot. So that slow-moving inventory you’re holding for the holidays is burning cash at an astronomical rate. And Amazon doesn’t send you a friendly reminder saying “Hey, your stuff’s about to get expensive.” They just quietly deduct it from your disbursements.

Working together, we help brands build automated inventory velocity tracking that flags products approaching these thresholds. Not sexy, but it typically saves $500-$2000 monthly for brands doing a few hundred thousand in annual revenue.

The Referral Fee Mathematics Most Sellers Get Wrong

Everyone knows about the 15% referral fee. What they don’t calculate is how it stacks with other percentage-based costs to create a margin death spiral. Here’s the honest breakdown of what actually hits your bottom line on a typical $30 product:

Start with that 15% referral fee - there goes $4.50. Add your 30% product cost, that’s another $9. FBA fulfillment runs about $4.25 for a standard one-pound item. Returns processing in categories like apparel? Factor in another 8% effective cost. Before you’ve spent a dollar on advertising, you’re at $20.15 in costs on your $30 item.

But wait, there’s the stuff nobody mentions. Low inventory level fees kick in when you drop below 28 days of supply. Unplanned service fees hit when Amazon has to add a barcode or poly bag. Inbound placement fees unless you’re using their preferred shipping method. Each one seems small, maybe fifty cents here, a dollar there. Stack them up? They’ll eat another 10-12% of your selling price.

The partnership approach we’ve developed helps brands see their true unit economics, not the fantasy version in their spreadsheets. Because knowing you’re making $2 per unit instead of the $8 you thought changes every decision about advertising spend, inventory orders, and growth strategy.

Why Your Bestsellers Might Be Your Biggest Losses

This one hurts to hear, but I need to be transparent: your top-selling products might be bleeding cash. We regularly see brands celebrating their bestseller status while losing seventeen cents on every unit sold. How does this happen?

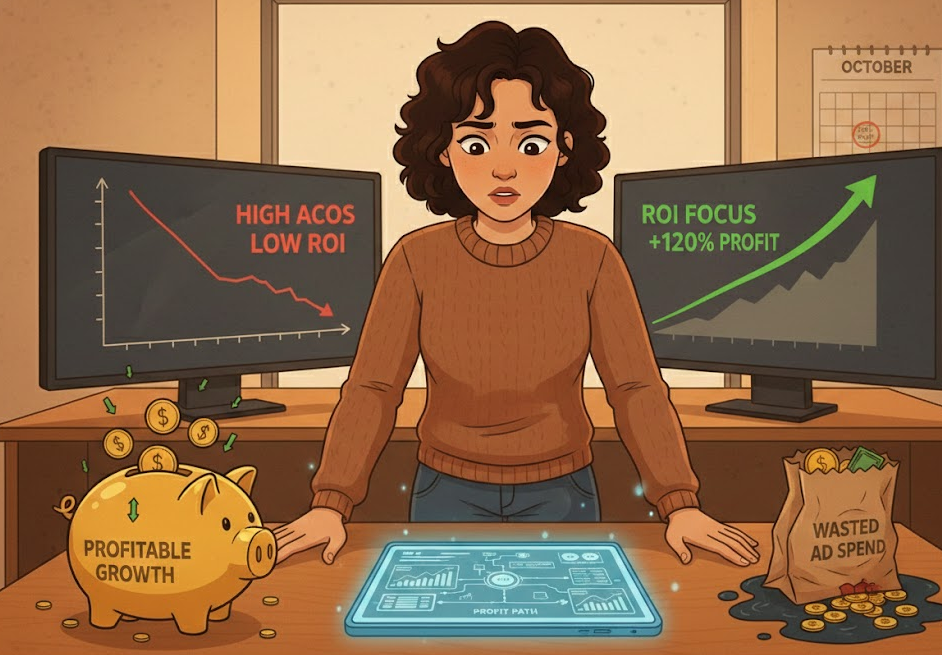

It’s the invisible profit leak of competitive pricing pressure combined with advertising costs. Your bestselling product attracts competition. Competition drives prices down. You match prices to maintain the Buy Box. Meanwhile, your advertising cost per sale creeps from $3 to $7 to $12 as competition intensifies. The product that launched at 40% margin is now operating at negative 5%, but the velocity masks the bleeding.

Here’s a real example without naming names: A kitchen brand doing roughly seven figures annually had three products accounting for 60% of revenue. Seems great, right? Deep analysis revealed those three products were losing $3.47 per unit after true cost allocation. The profitable products? The boring ones nobody paid attention to, sitting at 47% margins because they faced less competition.

What most brands don’t realize is that Amazon rewards velocity with better organic ranking, creating a trap. You keep feeding the beast, thinking growth will solve the margin problem. But scaling unprofitable products just means losing money faster. The partnership approach involves regular SKU rationalization - which sometimes means killing your babies.

The Return Rate Reality Check

Nobody wants to talk about returns, but here’s some full transparency: if your return rate exceeds 10% in most categories, you’re probably operating at break-even or worse. And certain categories - clothing, electronics, anything with sizing issues - average 20-30% returns.

Returns don’t just cost you the shipping fees you don’t get back. There’s the return processing fee, the cost of unfulfillable inventory, the disposal fees for damaged goods, and the invisible cost of suppressed Buy Box when your order defect rate climbs. A $40 shirt with a 25% return rate effectively costs you $12-15 per successful sale in return-related expenses.

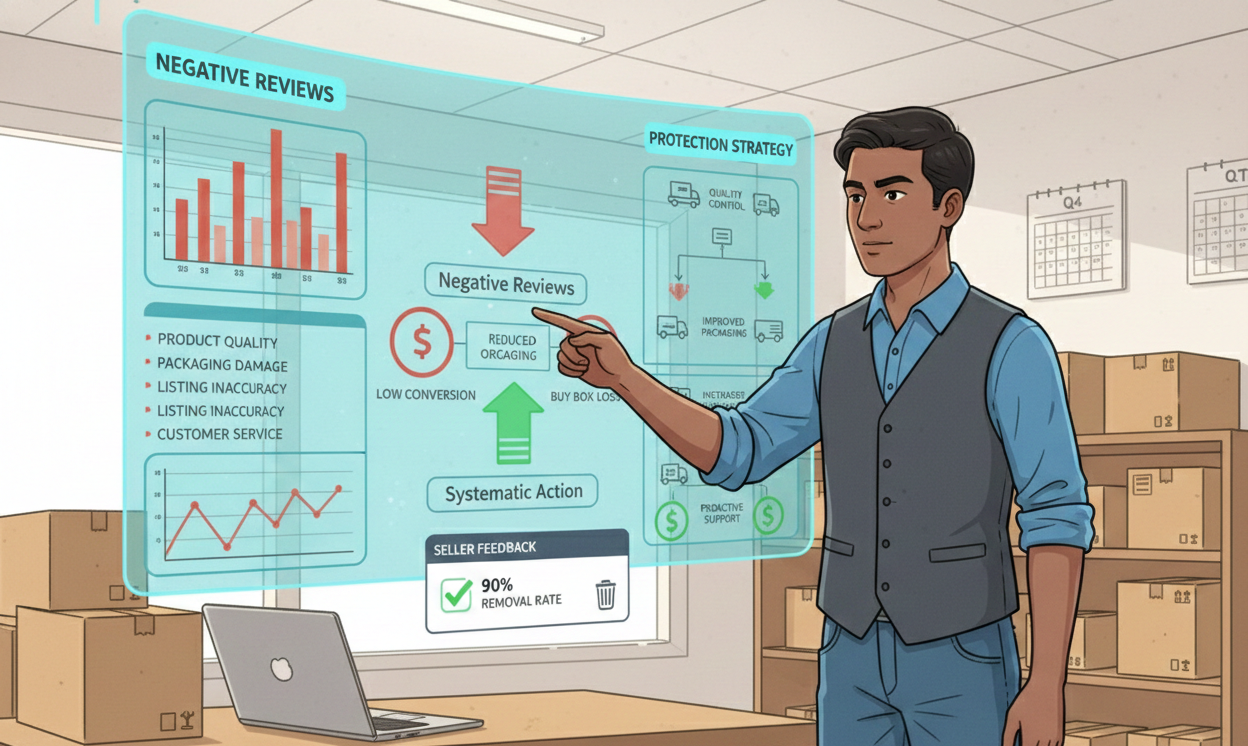

We help brands implement a systematic analysis of return reasons to identify fixable problems. Sometimes it’s as simple as better size charts. Often it’s about product bundling to increase perceived value. But you can’t fix what you don’t measure, and Amazon’s return reports are deliberately opaque.

The Professional Partnership Threshold

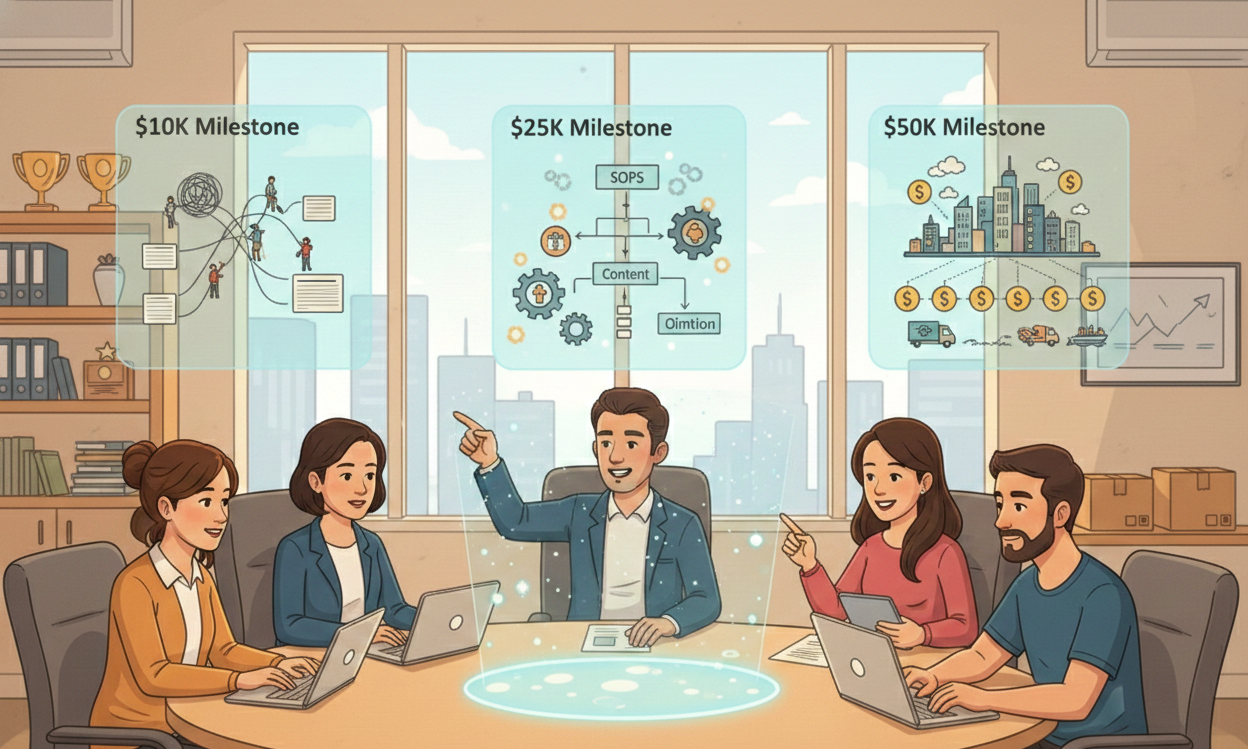

Let me give you the honest numbers about when professional profit optimization makes sense. If you’re doing less than $20,000 monthly on Amazon, DIY spreadsheet tracking probably works fine. Download your transaction reports, build some basic formulas, check them weekly. You’ll catch the obvious leaks.

Between $20,000 and $100,000 monthly? That’s where the complexity overwhelms most spreadsheet systems. You’ve got multiple SKUs, varying fee structures, seasonal inventory, advertising costs to allocate. The hidden leaks we’ve discussed start really impacting your bottom line. This is typically when a partnership approach delivers immediate ROI.

But here’s what we won’t do: promise magical margin improvement without operational changes. Real profit optimization means making hard decisions about SKUs, pricing, and inventory. It means accepting that some popular products need to go. It requires discipline to maintain margin standards even when competitors race to the bottom.

Your Profit Optimization Action Plan

Based on our team’s 20+ years of combined Amazon experience, here’s exactly where to start your profit recovery:

First, pull your last 90 days of transaction data and calculate your true unit economics including ALL fees - not just the obvious ones. Include storage, returns, advertising, and every miscellaneous charge. You’ll probably be shocked. That’s normal and healthy.

Second, identify your products over 150 days old in FBA inventory. These are ticking time bombs for aged inventory surcharges. Either move them fast with aggressive promotions or remove them before the 181-day threshold. The liquidation loss is usually smaller than the storage fee accumulation.

Third, segment your products by actual contribution margin after all costs. Not revenue, not units sold - actual dollars in your pocket. You’ll likely find that 20% of your SKUs generate 80% of your profits, while the rest lose money. This tells you exactly what to cut.

Working together through our partnership approach, we systematically implement these optimizations plus advanced strategies like dynamic repricing, strategic inventory placement, and return rate optimization. We’re not just sending reports - we’re actively managing the profit recovery process.

The Full Transparency Close

Here’s some full transparency about profit optimization: it’s not sexy, it’s not fun, and it requires saying no to growth opportunities that don’t meet margin thresholds. Most agencies won’t talk about cutting SKUs or raising prices because it might reduce gross revenue. But we’re not most agencies.

The partnership approach means we succeed when your profits increase, not just your revenue. Sometimes that means shrinking to grow. Often it means eliminating bestsellers that are secretly loss leaders. It always means rigorous margin discipline.

If you’re ready for an honest assessment of your true Amazon profitability, let’s have that conversation. We’ll analyze your last quarter’s data, identify your specific profit leaks, and calculate whether professional optimization makes financial sense for your situation. No sugarcoating, no false promises - just mathematical reality about your margins.

Because at the end of the day, as I’ve heard over and over from one of my favorite Ecom podcasts, the Ecom Crew, “Revenue is vanity, and profit is sanity”. In today’s Amazon marketplace, sanity is in short supply.

Ready to stop the bleeding and start building real, sustainable profit?

Reach out to schedule your profit optimization assessment - we'll show you exactly where your money's going and whether we can help you keep more of it.

Nick Hinton leads Elbert Mountain's Peak Season Strategy practice, helping growing Amazon brands navigate the chaos of Q4 and emerge profitable. With over 20 years of combined Amazon experience, Elbert Mountain specializes in emergency interventions and strategic planning for independent brands.