Amazon Commission-Based Growth: Why Aligned Interests Win

Most Amazon brands don't fire their agency over results. They fire them over suspicion. That nagging feeling that the people "managing" their account aren't truly invested in their success. The retainer hits the bank account every month regardless of whether revenue grew, flatlined, or cratered. The agency says all the right things in status calls, but something feels off.

We've found this through many conversations with brands making the switch to performance-based partnerships. The pattern is remarkably consistent: the previous agency technically did the work, but the relationship felt transactional rather than collaborative. Reports got delivered, campaigns got adjusted, and yet somehow the business owner always felt like they were pushing harder than the people they were paying.

The difference between a flat-fee agency relationship and a commission-based partnership isn't just about money. It's about alignment. When your growth directly affects your partner's income, the entire dynamic shifts. Conversations change. Urgency changes. The definition of "doing good work" changes. This isn't theoretical. It's behavioral economics playing out in real time across thousands of Amazon brand relationships.

The Hidden Problem with Flat-Fee Arrangements

Flat-fee retainers make perfect sense on paper. Predictable costs, defined scope, clear expectations. For agencies, they're even better. Guaranteed revenue regardless of performance. Once a flat-fee agency has your retainer locked in, their financial incentive is to do the minimum to keep you from leaving.

That's not a criticism of any particular agency. It's just how incentives work. When doing more doesn't pay more, and doing less still pays the same, human nature leans toward efficiency. The result is often competent but uninspired account management.

What typically happens: Your account gets handed to a junior manager once the sale closes. Strategy calls become status updates recycling the same metrics you could pull yourself. Proactive optimization suggestions dry up after the honeymoon period. The agency hits their service-level agreement (SLA) requirements without actually pushing for breakthrough growth.

For brands doing a few hundred thousand annually on Amazon, this mediocrity is expensive. You're paying $3,000-$7,000 monthly for maintenance when what you actually need is aggressive growth. The opportunity cost compounds month after month while your agency collects the same check regardless.

How Commission-Based Models Change Behavior

When an agency earns a percentage of your sales or profits, their behavior shifts fundamentally. Suddenly, that extra 5% conversion rate improvement matters to them personally. Testing a new keyword strategy on a Friday afternoon instead of waiting until Monday becomes worthwhile. Digging into why a particular ASIN underperforms moves from "nice to do" to "directly affects my income."

We structure partnerships this way because we've seen what happens when both sides have real skin in the game. The dynamic stops feeling like vendor-client and starts feeling like actual partnership.

Real-world effects we've observed:

Faster response times. When your revenue affects our revenue, letting an issue fester over a weekend stops making sense. Problems get addressed urgently because delays literally cost us money too.

More aggressive testing. Flat-fee agencies often play it safe because optimization experiments carry risk but no upside for them personally. With aligned incentives, testing becomes worthwhile. The potential payoff justifies the effort.

Proactive opportunity identification. Nobody has to remind us to look for growth opportunities. We're scanning for them constantly because finding them benefits both sides equally.

Honest conversations about what's working. When we're invested in outcomes, we stop sugarcoating underperformance. There's no incentive to spin poor results when doing so just prolongs a problem that hurts everyone..

Understanding the Math Behind Alignment

The typical commission-based Amazon partnership structure combines a smaller base retainer with a percentage of sales. The numbers will vary, depending on your business size, SKU count and complexity.

Some brands initially balk at the percentage component. Compared to a flat retainer, the aligned model might cost slightly more.

But here's what that comparison misses: the agency under the flat-fee model has zero financial incentive to grow the brand. They get paid the same whether you stay flat or double. Under the aligned model, growing you another 25-50% grows their bottom line as well as keeps you as a lifetime client.

The math creates a positive feedback loop. Every growth initiative that works pays both parties. Every successful test compounds. The agency becomes genuinely motivated to pursue your growth because their growth depends on it.

For brands approaching seven figures annually on Amazon, this alignment becomes particularly powerful. The upside potential for an engaged partner is significant enough to attract senior-level attention rather than junior account managers.

When Commission Models Don't Make Sense

Transparency requires acknowledging that performance-based partnerships aren't universally ideal. Several situations call for different structures.

Brand new Amazon launches often need significant upfront work before revenue materializes. Spending months on listing optimization, content creation, and initial advertising setup produces no commission income if the brand hasn't launched yet. Hybrid structures with higher base fees during launch phases address this.

Highly seasonal businesses can create cash flow challenges for both parties. If 70% of your annual revenue happens in Q4, a straight percentage commission means feast-or-famine economics that might not suit your partner's business model.

Extremely low-margin categories sometimes can't support meaningful commission percentages. If you're working with 15% gross margins on commodity products, there's limited room to share with a partner.

Brands primarily needing project work rather than ongoing optimization might get better value from project-based pricing. A one-time listing overhaul or PPC audit doesn't necessarily benefit from an ongoing revenue-share structure.

Typically, we see the win/win being a

hybrid approach with a small retainer to keep the lights on with a deep bench as well as a % of sales. The right fit depends on your specific situation.

Attribution: The Challenge Nobody Wants to Discuss

Performance-based arrangements require clarity about what counts as performance. This is where many agency relationships get complicated.

When sales increase 23% after three months of partnership, how much of that resulted from agency work versus seasonal trends, versus marketplace changes, versus improved products? Attribution is genuinely difficult, and agencies that pretend otherwise aren't being honest.

Successful commission structures require agreed-upon measurement frameworks before the partnership begins. What revenue counts toward commission calculations? Are certain sales excluded (like massive wholesale orders that don't touch advertising)? How do we handle returns? What about new product launches versus existing catalog?

These aren't gotcha questions. They're practical considerations that need clear answers. Brands burned by vague performance arrangements often discover the problem was ambiguous terms, not the fundamental model.

Finding the Right Partnership Structure

Evaluating potential agency partners becomes clearer once you understand the incentive dynamics at play. When interviewing agencies, the compensation model tells you something important about how they'll actually behave once you're a client.

Ask directly: How do you make money from this relationship? Then watch whether they squirm or explain confidently. Agencies comfortable with transparency around their business model tend to be comfortable with transparency in other areas too.

Pay attention to what happens when you ask about underperformance scenarios. Flat-fee agencies often deflect. Aligned partners acknowledge that poor performance hurts them too, which is exactly why they work harder to prevent it.

The partnership approach we've developed doesn't pretend to be right for everyone. But for brands doing low six figures to multiple seven figures on Amazon, genuine alignment of interests typically outperforms relationships where one party profits regardless of outcomes.

Reach out for a free evaluation of your Amazon account to see what we could do for you. If we don't think we can add much value, we'll be transparent and point you in the right direction.

Building Listings That Convert Long-Term

Listing optimization isn't about formulas or copying competitors. It requires understanding buyer psychology, testing systematically for your specific products and category, and building continuous optimization frameworks that adapt as competition and preferences evolve.

Brands succeeding long-term treat listing optimization as ongoing discipline, not a one-time project. They focus on conversion improvement over keyword ranking. They recognize when professional expertise delivers better returns than expensive trial-and-error learning.

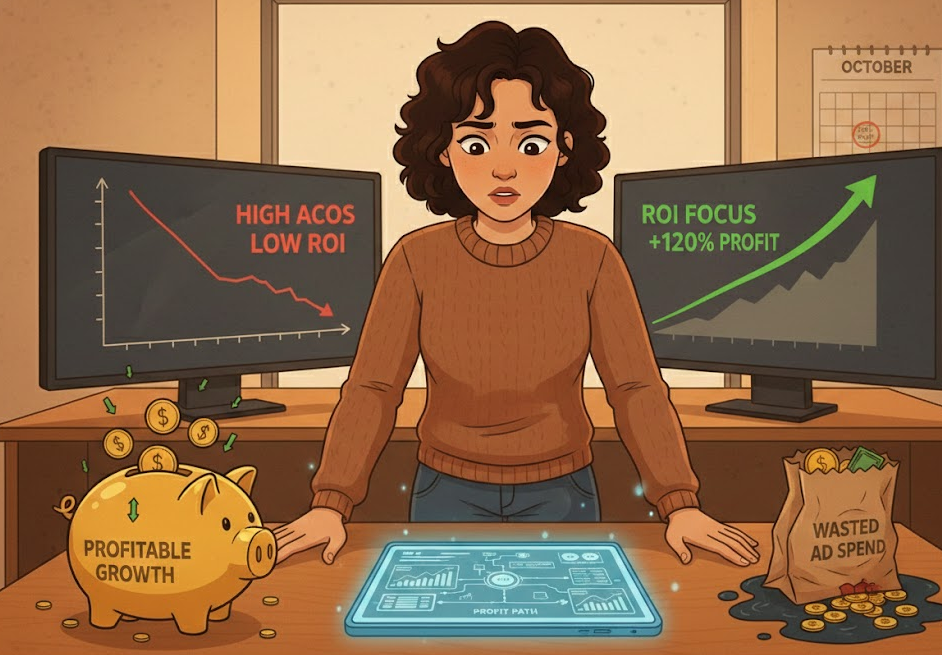

Converting below 5% while spending thousands monthly on PPC to compensate? That's normal. Most brands fight with suboptimal listings because they optimized once, saw acceptable results, and moved to other priorities.

The path forward is straightforward: systematic testing frameworks, mobile-first optimization, conversion psychology expertise, and either deep specialized knowledge or professional partnership. These aren't secrets - they're just skills that take years to develop through optimizing extensive product catalogs across competitive categories.

But it requires actual commitment. Not hoping better keywords will magically improve conversion. Actually changing how you approach listing development fundamentally. Building testing systems. Implementing optimizations. Making investments that enable sustainable high-conversion listings.

Many sellers never do this. They keep tweaking titles randomly, swapping images without testing, wondering why conversion rates stay stuck at 3-5%. The ones who commit to systematic optimization? They're the ones converting at 15%+ and scaling profitably.